Does Gold belong in my portfolio?

When stockmarkets are volatile, gold prices often jump. Any investment which has recently risen in value will receive media attention, so people want to know if they should react. Stewart Partners’ approach to investing is founded on evidence, so we do not include any direct exposure to this commodity in client portfolios. Let us explain why.

What is the inherent value of Gold?

Views on gold as an investment are generally more a matter of philosophy rather than fact. Gold is a difficult asset to value and market commentators love to speculate what is causing the daily moves.

As a result of the fixation by many people on short-term gyrations, little discussion seems to go into the value of owning gold as part of a long-term portfolio. Unlike shares and bonds which generate income payments, gold doesn’t generate regular cash-flows so investors in gold can only benefit from capital returns.

Unlike other commodities like iron ore or oil, there’s little industrial use for gold. It doesn’t power our smartphones or enable the production of steel for buildings.

Gold is a commodity that sits in the pool of investments that will never produce anything, but are purchased in the buyer’s hope that someone else will pay more for them in the future. In his February 2012 letter to Berkshire Hathaway Inc shareholders, Warren Buffett provided an explanation of why he personally does not invest in gold:

This type of investment [gold] requires an expanding pool of buyers, who, in turn, are enticed because they believe the buying pool will expand still further. Owners are not inspired by what the asset itself can produce – it will remain lifeless forever – but rather by the belief that others will desire it even more avidly in the future. The major asset in this category is gold…however, [it] has two significant shortcomings, being neither of much use nor procreative. True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end. What motivates most gold purchasers is their belief that the ranks of the fearful will grow…As “bandwagon” investors join any party, they create their own truth – for a while.

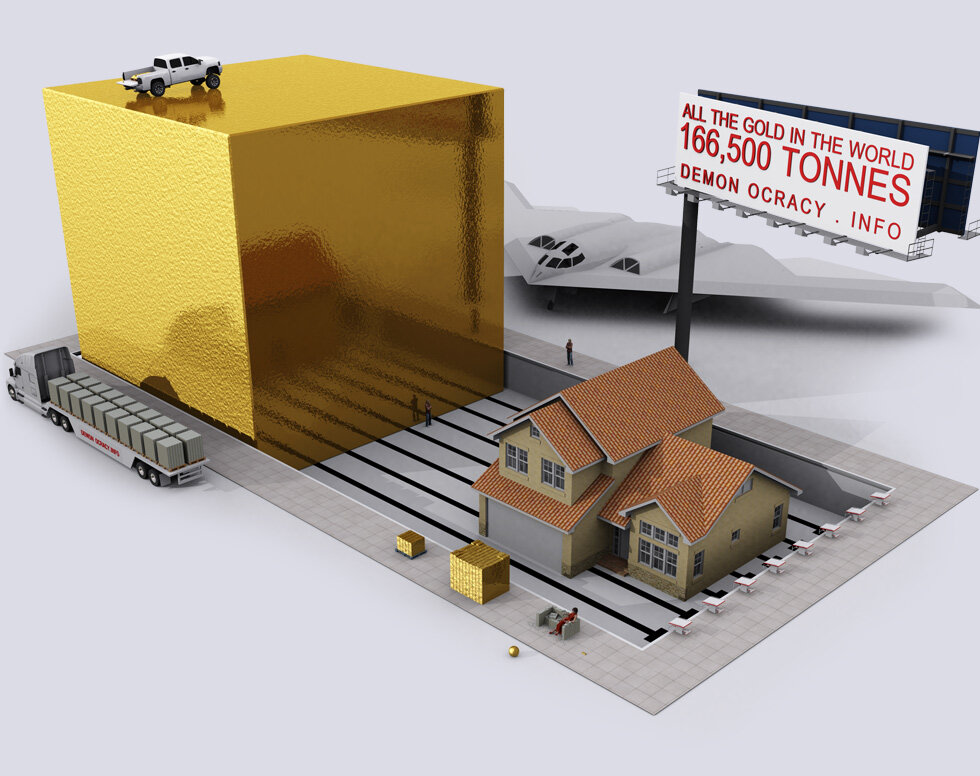

Today the world’s gold stock is about 170,000 metric tons. If all of this gold were melded together, it would form a cube of about 68 feet per side. (Picture it fitting comfortably within a baseball infield.) At $1,750 per ounce – gold’s price as I write this – its value would be $9.6 trillion. Call this cube pile A. Let’s now create a pile B costing an equal amount. For that, we could buy all U.S. cropland (400 million acres with output of about $200 billion annually), plus 16 Exxon Mobils (the world’s most profitable company, one earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge). Can you imagine an investor with $9.6 trillion selecting pile A over pile B?

Beyond the staggering valuation given the existing stock of gold, current prices make today’s annual production of gold command about $160 billion. Buyers – whether jewelry and industrial users, frightened individuals, or speculators – must continually absorb this additional supply to merely maintain an equilibrium at present prices. A century from now the 400 million acres of farmland will have produced staggering amounts of corn, wheat, cotton, and other crops – and will continue to produce that valuable bounty, whatever the currency may be. Exxon Mobil will probably have delivered trillions of dollars in dividends to its owners and will also hold assets worth many more trillions (and, remember, you get 16 Exxons). The 170,000 tons of gold will be unchanged in size and still incapable of producing anything. You can fondle the cube, but it will not respond. Admittedly, when people a century from now are fearful, it’s likely many will still rush to gold. I’m confident, however, that the $9.6 trillion current valuation of pile A will compound over the century at a rate far inferior to that achieved by pile B.

We find it hard to add anything to Warren’s considered explanation, but if you want proof an asset is valued based on the present value of its future cashflows, you can read our article: why-youre-crazy-to-sell-when-shares-prices-fall

Why might you buy gold in a portfolio?

If you read articles on why some people espouse holding gold in a portfolio, the common reasons are:

Gold holds its value in a downturn. Whilst this is true, the high credit quality bonds we recommend our clients own also hold their value in a market downturn. So there are several ways you can hold capital stable assets to meet your cashflow needs when your share portfolio goes through its inevitable ups and downs.

Gold can be liquidated easily in a stress market. If you hold physical gold, it’s still not as easy to liquidate as securities traded in deep, public markets. The bond portfolios we recommend can be redeemed in 3 to 5 business days and have never experienced issues with timely redemptions.

The negative correlation between shares and bonds has weakened, meaning bonds may not provide as much of a cushion in a share market correction. Gold has a very low or negative correlation with most investment assets. It is possible to selectively choose indices to prove or disprove this assertion. Most of these arguments are based in certain cases surrounding large historical episodes (such as World World 2), rather than most of the ordinary years an investor will participate in. So in order to profit from this logic, it leaves investors the extraordinarily difficult task of anticipating major historical events before anyone else.

For those who like the numbers, the correlation between global shares and global bonds was +0.32 between July 1990 and June 2000, -0.31 between July 2000 and June 2010 and -0.10 between July 2010 and June 2020 [1]. So bonds remain negatively correlated to stocks.

Whilst government bonds have historically been safe, today there is US$16 trillion of government debt issued by creditworthy governments that trade on negative yields. This is true, but as the graphs below show, there is no guarantee your purchase of gold will be worth more when you sell it.

Insurance policy against currency devaluation – if governments need to print money to repay their debts, this may lead to inflation and the devaluation of their currencies. Holding gold may help to maintain the purchasing power of wealth.

What the academics say

Between 1970 and February 2010, the return of gold was quite close to the return of the U.S S&P 500. Whilst the volatility of the gold price had been much greater than the stockmarket, a question was posed to Eugene Fama, Professor of Finance at the University of Chicago Booth School of Business and the subsequent 2013 Nobel Laureate for Economic Sciences, on whether gold can make a useful contribution to an investment portfolio. Fama’s answer was an emphatic “no” for several reasons:

You should not judge the past average return of gold as the best estimate of its future expected return.

Most of the stock of gold is in the form of jewellery and other goods that pay a “consumption dividend” (which is the academic way of saying something that brings you joy!). This dividend increases the current price of gold and lowers its expected capital gain return. But an investor who holds gold bullion as a portfolio asset only expects to get the expected capital gain, which does not suffice to compensate for the risk of the asset.

If the capital gain return on gold is uncorrelated or even negatively correlated with the return of other assets like stocks, then portfolio theory implies that the expected return on gold is low. Thus, for investors who do not value the consumption dividend, the expected return on gold does not cover its risk as a portfolio asset, (which takes account of its value for portfolio diversification).

We should have reasons for our investment decisions—reasons rooted in economic logic and portfolio theory. Principles of modern finance suggest that the primary components of a diversified portfolio should have expected return. Only projected earnings can generate expected return. Because gold doesn't produce anything, it has no projected earnings stream and therefore no expected return. Gold is just a metal.

So with good cause, people rarely talk about gold as an asset class with positive expected return. Instead they talk about it as a "diversifier"—some form of protection against economic harm. Specifically, investors seem to view gold as a hedge against inflation and currency devaluation. Maybe they see gold itself as de facto currency. After all, gold has been used on and off as money across many civilizations through history, sometimes surviving other local coin.

But modern finance suggests that, like metals and other commodities, currencies are not investments with expected return. Currencies do not produce anything; and though they fluctuate relative to each other, the fluctuation is unpredictable. There is no economic reason to expect any currency to be worth more tomorrow than it is today.

On some level, the same can be argued about any financial asset, which may be why speculating is so often confused with investing. Things are only as valuable as everyone agrees they are. The whole system relies on consensus; the bank has to agree you gave it money earlier, and society in general has to agree that the agreement between you and the bank is real and binding.

Uncertainty is scary, but it is a fact of life investors accept. Fortunately, modern finance gives us a way to parse uncertainty. Asset pricing teaches us that some risks are more worth taking than others. The risks most worth taking are those that come with expected return. With stocks and bonds, investors put their money to work in the capital economy. The money they invest helps power enterprises that generate growth and productivity. This is what earns expected return. Simple commodities like gold do not create economic growth. "Investing" in gold is at some level just speculating: you hope the price will go up but have no real reason to expect it to.

What return has Gold delivered over time?

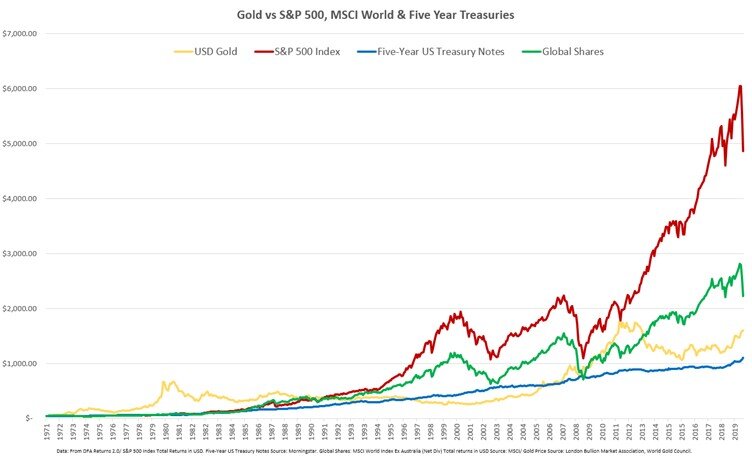

In December 1971, US President Nixon abandoned the Gold Standard, which until that time meant a currency’s value was directly linked to the amount of gold held by a country. The chart below tracks the gold price in US dollars against the U.S S&P 500 Index, Five Year US Treasury Notes and Global Shares from December 1971 to June 2020.

Source: Mancell Financial Group

Clearly gold has enjoyed some strong periods, culminating in a high in 1980. And you can see over the period to February 2010, when Fama answered the question above, the gold price had indeed performed similarly to the S&P 500.

Unfortunately, anyone buying gold in 1980 would need to wait 28 years for the GFC of 2008 before the gold price reclaimed its 1980 level. The most recent high was in September 2011, when there was uncertainty around issues like the financial stresses of Greece. Whilst gold has enjoyed a good run since September 2018, it took until July 2020 to pass this previous high.

Measured against a share market index, like the S&P 500, gold is trailing in long term wealth creation. So maybe gold is better classified as a defensive asset? Long term against fixed interest, gold has proven a better prospect looking at average returns, but price volatility is far higher (even higher than stocks) and investors do not benefit from an income stream.

Jeremy Seigel's book "Stocks for the Long Run" includes the growth of $1 of various investments from 1802 through December 2006. After being adjusted for inflation, gold grew from $1 to $1.95 while stocks grew from $1 to $755,163. At those rates, stocks have an average annualized appreciation over inflation of 6.86%, whereas gold is just 0.33% over inflation.

Gold vs Currencies

Perhaps the impulse to own gold is an emotional response to global events when there is a risk of currencies being devalued. In this event, gold could he held as a true store of wealth. This is a speculative forecast that some people believe holds true.

Depending on what country you are in can make a significant impact on whether holding gold in difficult times is valid. If you are a US investor, the current gold price (which is quoted in US dollars) remains below the September 2011 high. However, in Australian dollars, the gold price is at an all-time high as the Australian dollar has steadily lost value against the US dollar.

Source: Mancell Financial Group

So, when investing in gold, currency movement becomes another risk to be considered and managed. In recent times you can find forecasts for the Australian dollar ranging from 40 to 80 cents. Who to believe?

Summary

Gold is not an investment but rather a store of value. The term "investment" describes something that pays you money, like stocks, bonds, or rental properties.

Since December 1971, the value of gold appears to be highly correlated to fears of economic or political collapse. This appears to make gold a fallback, rather than an investment.

The two main arguments against holding gold are the expected return is low (little more than inflation) and the price is as volatile as stocks.

A well-diversified equity and fixed income portfolio is likely to provide investors natural exposure to gold/commodities through ownership of companies that produce and sell those commodities or use them in production. Hence, a separate allocation to gold/commodities might not necessarily expand the investment opportunity universe for most investors who are heavily reliant on their portfolio to fund their lifestyle.

Author: Rick Walker

[1] Source: MSCI World Index (net div AUD) used as a proxy for global shares and Bloomberg Barclays Aggregate Bond Index (hedged to AUD) used as a proxy for global bonds. Correlation data calculated in Returns Program for each 10 year period.