Stock Market Returns: The Gap Between Average and Reality

When asked about expected returns from stocks, I often hear investors cite the historical average annual return as a reasonable proxy for what they might achieve over the next year. I caution against this approach.

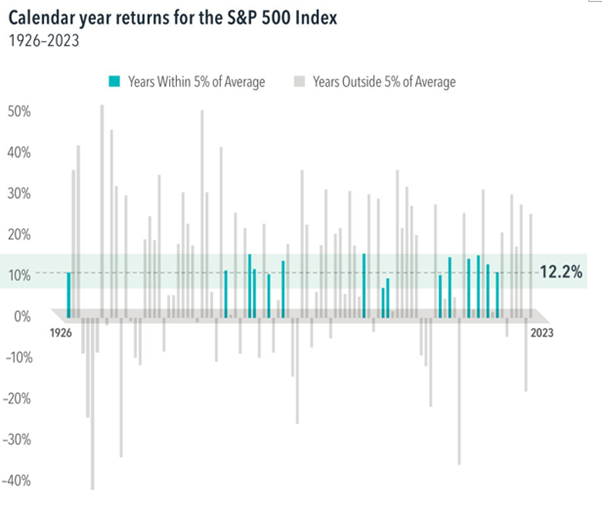

The most comprehensive dataset for stock market returns is the S&P 500 Index in the U.S., which extends back to January 1926. From January 1926 to December 2023, the average annual return of the S&P 500 was an impressive 12.2%. However, while this figure can be useful, it does not guarantee that your actual annual returns will reflect this average. In fact, they often diverge significantly.

The graph (source: Dimensional Fund Advisors) shows of the 98 calendar years in this period, only 15 years saw returns within five percentage points of the average (falling between 9.7% and 14.7%). The remaining 83 years exhibited deviations averaging over 18 percentage points. The best 12-month return was a staggering +162.9% (beginning in July 1932), while the worst was a dramatic -67.6% (starting in July 1931), both of which are tied to the Great Depression.

Excluding the tumultuous 1930s and starting from January 1940, the best 12-month return recorded was +61.2% (beginning in May 1942), and the worst was -43.3% (starting in March 2008). The peak return illustrates that periods of war can yield positive outcomes for stock markets, whereas the decline corresponds to the Global Financial Crisis (GFC).

This data underscores the inherent volatility of stock markets. Market conditions are influenced by a multitude of factors—economic indicators, political events, and global conflicts—all of which continually evolve and shape investor sentiment.

While stock markets tend to trend upwards over time, the path is rarely linear. A prudent asset allocation strategy is essential for helping investors navigate these fluctuations. It ensures that you are not pressured to sell stocks during a downturn due to immediate cash flow needs. Moreover, understanding the potential for deviation from historical averages is critical for managing expectations and making informed financial decisions grounded in strategy rather than emotion.

Author: Rick Walker